- October 16, 2024

The Role of Central Banks and Interest Rates in Forex Trading

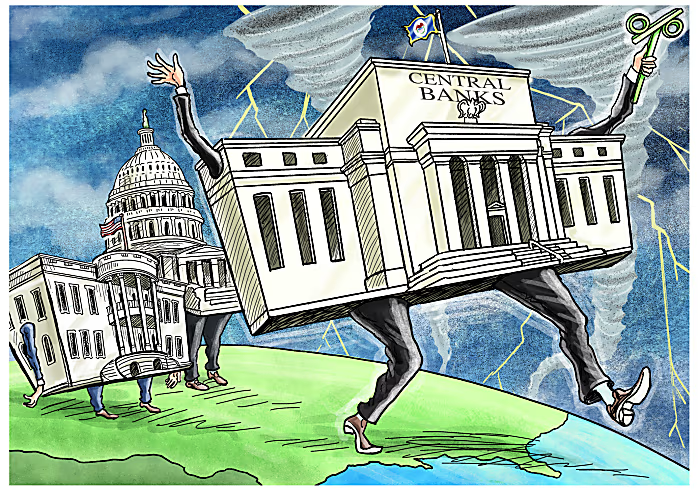

Central banks and interest rates play a pivotal role in shaping the global forex market. They are the main drivers of currency values, and their policies can cause significant fluctuations in exchange rates. For forex traders, understanding the influence of central banks and how interest rates impact currency prices is essential to making informed trading decisions.

In this article, we’ll explore the role of central banks in the forex market, how interest rates affect currency pairs, and the tools traders can use to track central bank policies and economic indicators.

What Are Central Banks and Their Role in Forex?

A central bank is a national institution that oversees a country’s monetary policy, regulates its currency, controls money supply, and sets interest rates. Central banks play a critical role in maintaining financial stability and fostering economic growth. Some of the most important central banks in the world include:

- The Federal Reserve (Fed) in the United States.

- The European Central Bank (ECB) in the Eurozone.

- The Bank of Japan (BoJ) in Japan.

- The Bank of England (BoE) in the United Kingdom.

- The Reserve Bank of Australia (RBA) in Australia.

- The Bank of Canada (BoC) in Canada.

Central banks influence the forex market primarily through monetary policy, which includes the management of interest rates, money supply, and inflation. Their actions can significantly impact the value of a country’s currency.

Monetary Policy

Monetary policy refers to the strategies used by central banks to control the supply of money in an economy. There are two main types of monetary policy:

- Expansionary Monetary Policy: Central banks use this policy to stimulate economic growth by increasing the money supply and lowering interest rates. This can lead to a weaker currency as lower interest rates reduce the attractiveness of the currency for investors.

- Contractionary Monetary Policy: Central banks use this policy to curb inflation by reducing the money supply and raising interest rates. This can lead to a stronger currency as higher interest rates make the currency more attractive to investors seeking better returns.

By adjusting interest rates, central banks influence economic activity, inflation, and the value of their national currencies, which in turn has a direct impact on forex markets.

How Interest Rates Impact Forex Trading

Interest rates are one of the most important tools used by central banks to regulate the economy. Changes in interest rates can have a profound effect on the forex market, as they directly influence currency values and investor sentiment.

Interest Rate Differentials

The interest rate differential is the difference in interest rates between two countries. In forex trading, currencies are always traded in pairs, meaning you are simultaneously buying one currency and selling another. The interest rate differential between the two currencies in a pair plays a significant role in determining the direction of currency flows.

For example:

- If a country’s central bank raises interest rates, its currency will typically appreciate because higher interest rates attract foreign capital. Investors seek to benefit from the higher returns available in that country.

- Conversely, if a country lowers its interest rates, its currency may depreciate because investors seek higher yields elsewhere.

Traders often monitor interest rate differentials to predict currency movements. A wider interest rate differential between two currencies generally results in the strengthening of the currency with the higher interest rate and the weakening of the currency with the lower interest rate.

Carry Trade

The carry trade is a popular forex trading strategy that exploits interest rate differentials. In a carry trade, a trader borrows money in a currency with a low-interest rate and uses it to buy a currency with a higher interest rate. The goal is to profit from both the appreciation of the currency with the higher interest rate and the interest rate differential itself.

For example, if Japan has low interest rates and Australia has high interest rates, a trader might borrow yen (JPY) and use it to buy Australian dollars (AUD). The trader benefits from the higher interest rate in Australia and the potential appreciation of the AUD relative to the JPY.

While the carry trade can be profitable, it is not without risks. If the currency with the higher interest rate suddenly depreciates, the trader could face significant losses.

The Impact of Central Bank Announcements on Forex

Central bank decisions and announcements can cause significant volatility in the forex market. Traders closely follow central bank meetings, press conferences, and policy statements to gauge the future direction of monetary policy. Some of the key factors that traders look for include:

1. Interest Rate Announcements

Interest rate announcements are among the most closely watched events in the forex market. When a central bank raises or lowers interest rates, it can lead to sharp movements in currency pairs.

For example, if the Federal Reserve unexpectedly raises interest rates, the U.S. dollar is likely to strengthen as higher rates attract foreign investment. Conversely, if the Fed lowers interest rates, the dollar may weaken as investors seek higher yields in other currencies.

2. Forward Guidance

Central banks often provide forward guidance, which refers to the communication of future monetary policy intentions. Forward guidance gives traders insight into whether a central bank is likely to raise, lower, or maintain interest rates in the future.

For instance, if the European Central Bank signals that it will keep interest rates low for an extended period, traders may anticipate continued weakness in the euro, prompting them to sell EUR/USD or other euro-based currency pairs.

3. Quantitative Easing (QE) and Tapering

In addition to adjusting interest rates, central banks sometimes use quantitative easing (QE) to stimulate the economy. QE involves the central bank purchasing government bonds or other financial assets to increase liquidity and lower long-term interest rates.

While QE can stimulate economic growth, it often leads to currency depreciation because it increases the money supply. For example, the Fed’s quantitative easing programs following the 2008 financial crisis contributed to a weakening of the U.S. dollar.

Conversely, when a central bank begins tapering its asset purchases (reducing QE), it can signal a tightening of monetary policy, leading to currency appreciation.

Key Economic Indicators to Watch

Central banks base their interest rate decisions on various economic indicators, which are also essential for forex traders to monitor. These indicators provide insights into the health of an economy and the potential direction of monetary policy. Some of the most important economic indicators include:

1. Inflation

Inflation measures the rate at which prices for goods and services rise in an economy. Central banks typically aim to keep inflation at a stable level (usually around 2%). If inflation rises too quickly, central banks may raise interest rates to cool down the economy and prevent runaway inflation. Conversely, if inflation is too low, central banks may lower rates to stimulate spending.

2. Gross Domestic Product (GDP)

GDP is the total value of goods and services produced in a country and is a key indicator of economic growth. Strong GDP growth often leads to higher interest rates, as central banks may tighten monetary policy to prevent the economy from overheating. Weak GDP growth, on the other hand, may lead to lower interest rates to encourage spending and investment.

3. Employment Data

Employment reports, such as the non-farm payrolls (NFP) report in the United States, provide critical information about the health of the labor market. Strong job growth and low unemployment can lead to higher interest rates, as central banks may raise rates to prevent wage inflation. Weak employment data may lead to lower interest rates to stimulate job creation.

The Relationship Between Central Banks and Currency Wars

In some cases, central banks may engage in currency wars, where countries intentionally devalue their currencies to gain a competitive advantage in international trade. A weaker currency makes a country’s exports cheaper and more attractive to foreign buyers, boosting its economy. However, this can lead to retaliatory actions from other countries and cause significant volatility in the forex market.

For instance, the Bank of Japan has historically used policies aimed at weakening the yen to make Japanese exports more competitive. Similarly, the Swiss National Bank (SNB) has intervened in the forex market to weaken the Swiss franc, as a strong franc harms Switzerland’s export-driven economy.

Traders should be aware of the potential for currency interventions and consider them when analyzing central bank policies.

Conclusion

Central banks and interest rates are at the heart of forex trading. The decisions made by central banks can have a profound impact on currency values, and interest rate differentials drive much of the activity in the forex market. For traders, understanding how central banks operate, monitoring interest rate changes, and keeping an eye on key economic indicators are critical to making informed trading decisions.

By staying informed about central bank announcements, economic data releases, and monetary policy trends, forex traders can position themselves to capitalize on market movements and improve their trading outcomes. Whether you are a beginner or an experienced trader, having a firm grasp of the role of central banks and interest rates is essential for success in the forex market.